View in browser

The gaming accessories market has been continuously growing throughout the years, expected to surge to about USD 10 billion in a decade. More innovative and new platforms will reach out to gamers around the world. We take a look at one of the top world’s gaming accessory leaders, Turtle Beach Corporation, which produces high-quality and award-winning gaming products.

Turtle Beach Corporation (NASDAQ: HEAR)

Turtle Beach (HEAR 0.00%↑) founded by Roy Smith and Robert Hokein in 1985, has been a gaming leader for decades. It first developed synthesizer chips and award-winning powered sound cards while achieving prominence in the PC multimedia industry. In 1996, Voyetra Technologies acquired this dominant company and manufactured the first headset nine years after.

Turtle Beach Corporation is known for innovative and high-quality console gaming headsets suitable for gamers of all levels. It has a mission to help gamers do their best at every level and in every game. Since 2010, the company has sold over 60 million console headsets, a small portion of the USD 8.8 billion worldwide gaming accessory market.

It produces supreme gaming headsets for platforms like Xbox, Switch, and PlayStation. Gaming software, simulations, and controllers are its top sellers, making it a fan-favorite brand in console gaming audio. Also, the ROCCAT brand focuses on German-design gaming products, such as mice, mousepads and award-winning keyboards. The Neat Microphones brand embraces cutting-edge technology with high-performance digital USB and XLR microphones.

By 2021, Turtle Beach owned more than 40% gaming headset revenue share in the U.S., which dominates the market with three brands - Turtle Beach, ROCCAT, and Neat Microphones.

Shareholder Activism

In late April the Donerail Group (“Donerail”), a Los Angeles-based investment advisor who has ownership of approximately 7.4% of Turtle Beach’s outstanding shares, released a letter to criticise the performance of Turtle Beach. Donerail also discussed its management upon the appointment of Juergen Stark as CEO and President.

Donerail complained that the share price and the earnings of Turtle Beach have underperformed under Shark’s lead. It was criticised for operational missteps and had been pushing the company to sell itself. As such, Donerail sees the need to change the board of the company. Around a week after the release of Donerail’s letter, the company announced that it was seeking some potential investors for acquisition.

It also reached an agreement with Donerail in mid-May that it will complete the refreshment of board composition and the set-up of the Strategic Review Committee. The proposed board will comprise nine members, including three new directors nominated by Donerail, which allows it to involve in the operation and management. If the company fails to attract investors within a 120-days period, Donerail will have more possible shareholder intervention in the management and operation of the company.

After the news announcement of the agreement between Donerail and the company, the share price of the Company has reached 4.3% higher than the market open. Investors are optimistic about the recent milestone of the company.

Looking forward, it is foreseeable that the shareholder activism, board refreshment, and other strategic moves of the company may bring a significant positive change in the financial performance, operation, and management. In view that the large shareholders actively participate in the decision-making of the company, it is likely that Turtle Beach’s future will be more favourable to shareholders.holders.

Share Price

Turtle Beach's share price has dropped almost 70% over the past half a year, at the time of writing. It has suffered a larger decrease than its competitor, a public technology company Razer Inc. (OTCMKTS: RAZFF).

Despite the sluggish performance, Stark remains optimistic. He explained the decline is due to a lack of stimulus spending and consumer caution on discretionary spending considering inflationary amid the Covid-19 pandemic. Other macroeconomics concerns may have had an affect too.

However, with a 390% increase in stock price in almost four years, Turtle Beach is uncorrelated with and outperformed the financial market throughout the years, compared to Dow Jones, S&P 500, and NASDAQ Index. This gaming accessory leader may continue to grows and expand faster.

Market Expansion

As the U.S. top headset leader for 12 consecutive years, Turtle Beach's business has covered over 40% of the U.S. headset market and sold to over 40 countries across the Americas and Europe. To continue expanding the market share, it has just launched its Neat Microphones brand in Europe.

Turtle Beach continues to provide incredible experiences to gamers by launching new products. It has produced more simulations, controllers, and streaming products in 2021 than two years before.

Meanwhile, this headset leader has input more resources to maintain the competitiveness of the products. It includes “Superhuman Hearing,” which allows gamers to be a “superman” who can hear the subtle sounds like weapon loading in the game. Turtle Beach claims this even helps with the kill/death ratio in games - a 44% increase, and gamers played 20% longer time than usual.

The flight simulator VelocityOne Flight Simulator Control System was another state-of-art innovation by Turtle Beach last year, which was also the first time the Company stepped into the simulation market by cooperating with technology giant Microsoft.

“The two new accessory segments (recon controller and flight simulator) add another USD 1 billion of the global addressable market,” Stark said. “ PC/console flight simulation hardware adding roughly USD 400 million in the global market.”

Why Invest in Gaming Accessories?

With VR and the cloud developing rapidly, the gaming industry takes advantage of the brand new yet innovative technology. Under the hit of the mobile application Pokemon GO, VR and AR started sweeping the gaming community half a decade ago. With a growing number of mobile games, the gaming accessories industry revenues have pushed to a new highs. Its direct revenue in a few major countries has climbed more than a fifth in a year, reaching USD 200 billion in 2020, according to Accenture.

Apart from Turtle Beach, over 70 brands in the gaming accessories industry are also selling mouses, headsets, and controllers. But the market is still not consolidated yet. There is still room for new joiners, especially under the surging demand for gaming accessories, which will continue rising in the coming years. The growth will be more apparent in the Asia-Pacific region than in other countries.

What escalates the gaming accessories market the most is E-sports (short for electronic sport). It is a new form of competition using video games that require high-quality gaming gear, such as consoles, controllers, and monitors. This activity is more popular as the total number of E-sports viewers increased dramatically, from 397.8 million in 2019 to 465.1 million two years later. The compound annual growth rate is expected to reach 7.7 percent from 2019 to 2024, based on Newzoo’s data.

Other than the players, there are billions of audiences watching the game players live streaming on the global platform like Youtube, Facebook, and Bilibili. The number of audiences is expected to grow to 1.4 billion in 2025 from 0.8 billion last year. It pushes the development of e-sports as well as the gaming accessories needed. With that context, let’s look at the case for Turtle Beach and their financials.

What’s great

Sales

Entering additional new categories to drive further growth

The ROCCAT brand U.S. sell-through increased over 60% year-over-year

VelocityOne Flight sold out multiple times since its release in 2021

Launched 29 new ROCCAT PC gaming products in 2021 and Q1 2022

Profit

Revenue raised more than 55% in three years

5 Year revenue CAGR through 2021 is over 16%

Expecting $100M of non-console-headset revenues in 2022

Gross profit increased over 60% in two years from 2019

Debt

USD 24 million in cash with zero debt

Over USD 100 million in inventories 2021

USD 80 million revolving credit facility

What’s okay

Revenue in full-year 2022 is expected to approximately flat from its record 2021

Adjusted EBITDA loss in Q1 2022 was modestly above expectations, total USD (5.7) million

Earnings per share generally consistent starting from 2018

Gross margin is okay at 35% but has slowly declined over the years.

What isn't great:

High production cost still exists due to increased logistic costs and supply chain challenges

Net loss in Q1 2022 was USD (6.5) million, or USD (0.40) per diluted share

Total return on shareholders’ equity is declining sharply after the peak in 2018 due to the low income in recent years

Revenue & PE ratio

Turtle Beach’s revenue constantly increased these years, which doubled during the pre-covid period. Amid the pandemic, revenue still escalated, and EBIDTA grew 222.2% in 2020. It was also optimistic that the company cleared all its short and long-term debts in these two years, reaching a higher market capitalisation. Furthermore, today’s EV/EBITDA multiple would be 12.6x, which less than the S&P500 average and most previous years. Today it has a normalised P/E ratio of 19.

Cashflow

Turtle Beach’s cashflow was growing fast in the past few years, rising about 30% to USD 51 million in 2020. There has been a sudden drop last year which found only USD (327)k in cash flow, which is an effect of lower net earnings and working capital needs. Recent FCFE/yield also declined because of this. However, the average FCFE/yield over five years is 8.6% which is decent.

Forecast

The Covid-19 pandemic affects the gaming accessories market, which makes it difficult to predict the company’s future. The prediction is based on the assumption of buying shares at USD 18.14 a share as a principal investment in 2021. Historical data is also added as a reference.

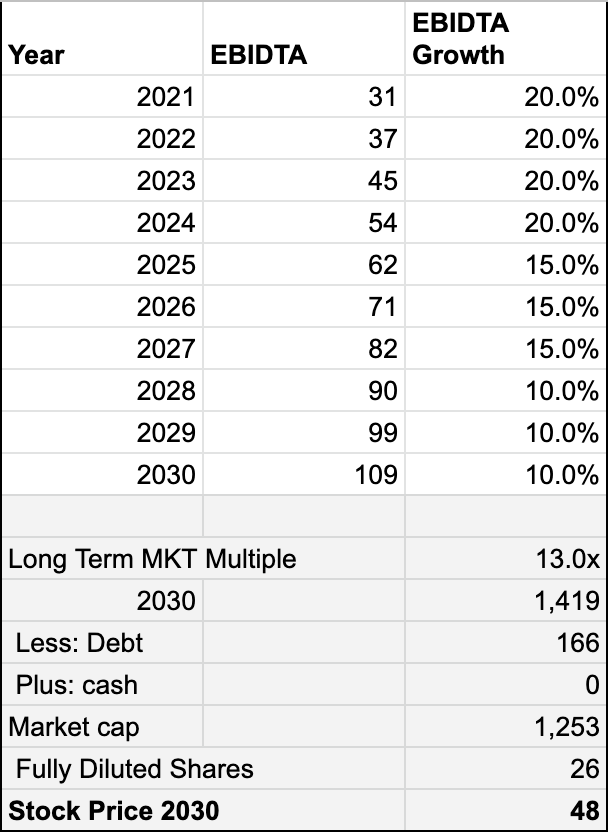

EBIDTA is foreseen to jump to USD 109 million in 2030, tripled from a decade earlier. It will keep surging throughout the years, with the constant growth of about 20%. Other than that, Giles Capital anticipates that the share price will reach USD 48 in 2030, and the market capitalisation will be at about USD 1.35 billion. Turtle Beach is expected to expand in the future.

For our FCFE forecast, we use the an average FCFE/share of 0.64 of the last 5 years. Let’s assume a it grows at a rate of 10%-20% a year. This gives us a target stock price of $31 by 2030.

We can purchase the stock at $18.14 today. When we average out our FCFE and EV multiple forecasts, we get a target price of $40.

Adding back the FCFE/Shr we model the future stock price at $40 in 2030. This equates to an IRR of 16% which is market beating. However this is dependant continued revenue growth, but excludes any buyout by other companies.

Summary

Turtle Beach is currently facing a supply chain and high logistics cost problem due to the pandemic. This leads to a short-term net loss, low margin, and low revenue. However, as a top gaming accessories world leader, especially in the U.S., it keeps launching new products and entering new markets. Flight simulations, VR, and controllers are examples that can potentially bring them new business and further expansion.

Under the growth of E-sports worldwide, Turtle Beach is taking advantage of its need for gaming accessories by producing high-quality and comfortable gear. It can potentially attract more customers and sales in the long term.

Despite that, this company is settling with Donerail Group, which has a high potential to sell the company very soon. Under changes in the board of directors and operation, the future of this gaming accessories leader remains slightly uncertain.

Giles Capital confidence score: 6/10

We have a consecutive attitude toward the future development of Turtle Beach because of its uncertainty in company operation and management. However, it is believed that the overall shareholders' interest could be safeguarded with the recent shareholder activism. If any new management is likely to be more shareholder friendly, it could have a positive impact on Turtle Beach and its value.

Interested to do your own analysis?

Check out our GCS tool that helps you pull in data so you can do your own analysis in Google Sheets. This is what we use to analyse companies financials statements.

Disclosure:

We currently do not hold a position in Turtle Beach but are interested in doing so.

Disclaimer:

This is not investment advice. Our content to be used for informational purposes only. It is important you do your own analysis before making any investment based on your own personal circumstances.

About:

Sign up to our free newsletter for more analysis & recommendations:

Stay invested and follow Giles Capital on Twitter at @GilesCapital.