View in browser

A lot has happened since our last update as we see the deplorable invasion of Ukraine by Russia resulting in unprecedented sanctions. We also see a resurgence of COVID in Mainland China and negative sentiment in many markets. This has slowed the recovery in tourism and travel. An area that has also changed significantly is tech stocks. Previously we’ve discussed potential investment ideas such as West Japan Railway Company in Japan and FPT Corporation in Vietnam. Today we’ll discuss our investment in Spotify from Sweden.

Spotify (NYSE:SPOT)

Spotify (SPOT 0.00%↑) has cropped up a few times fairly recently. One fantastic overview is by Matt at MT Capital Research. It lays out a strong thesis where Matt believes the following: 1) Audio has been significantly under-monetised and will grow due to Spotify's focus on ads, international expansion and pricing power. 2) Spotify will begin to have the upper hand in the relationship with record labels and 3) Spotify can continue to exert dominance in the audio industry.

The thesis is rather agreeable and it seems Spotify has significant tailwinds. If we look at global music revenues in the last two decades below, we can see a few things: 1) streaming has taken off since Spotify launched in the U.S. in 2011, but it is only in the several years it has become the most dominant. Overall streaming revenue has improved by 24.3% from the prior year and now represents 65% of total music industry revenue. 2) We can also see digital downloads have been almost phased out while physical sales have dropped significantly. 3) The global recorded music industry generated $25.9 billion in 2021 (+18% YoY). On a side note: for the first time in 20 years, there was growth in the physical market, partly driven by a recovery in physical retail and a resurgence of interest in vinyl.

This is certainly encouraging. Spotify’s monthly active users and revenue have both grown in double digits since inception, very much in line with overall industry trends. So one question a reader might have is where might future growth come from? To answer this question, in particular, I would like to focus on the growth of ad-supported revenue.

Ad-supported revenue driven by podcasts

As Matt at MT Capital Research points out, the audience of ad-supported audio on radio is surprisingly still substantial, taking up to 80% share of all ad-supported audio time spent, although this varies significantly with age.

For podcasts, this share can be anywhere from 9% to 23% and for Spotify itself, its share of ad-supported audio would be anywhere from 2% to 10%. However, we can easily see radio’s share will slowly decline as: 1) younger audiences opt for subscription-based audio such as Spotify, 2) the number of cars and devices that support radio declines, while ones that support Apple CarPlay or Android Auto increases and ultimately, 3) streaming becomes the de facto method of audio consumption. Furthermore, as podcasts are already up to 23% of the ad-supported audio share and increasingly get bundled into Spotify, Spotify will gain a significant share of ad-supported audio and revenue.

In many ways, this is already happening. When we take a look at the RIAA music revenue statistics, we can see below that ad-supported streaming revenue has grown 46.7% in the last year. However, for Spotify in particular we know that their ad-supported revenue has grown by 62% in the last year.

Not only is this an area for Spotify to grow into, but it also seems to be capturing this market better than its competitors. This is no surprise given Spotify’s recent strategies and acquisitions around audio, specifically around podcasting.

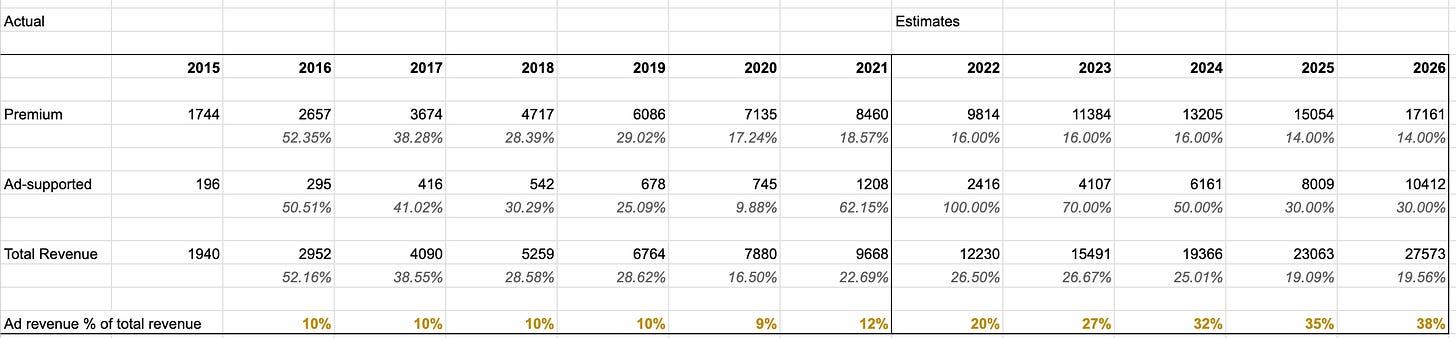

Spotify CEO Daniel Ek has stated that ad-supported revenue could make up 20% of total revenue by 2022 and up to 30-40% in 5-10 years. Assuming premium revenue keeps growing (assuming a lower rate of 16%), to reach these targets we would look at more than 100% growth in ad-supported revenue by 2022 and subsequent growth of 70-30% per year. This is illustrated below by applying these estimates to future revenue.

This suggests revenue might grow faster in the coming years even as premium revenue growth slows down. The main driver for this growth in ad-supported revenue apart from expected ad-supported music streaming growth would be podcasts. Ad spending for music streaming in the US alone was worth $3.65 billion in 2021, of which Spotify already has a large portion. What’s worth highlighting is ad spending for podcasts was $2.31 billion in the same year but is growing at a faster rate than ad spending for streaming and could be worth $4.26 billion by 2026. This is a lot of potential revenue Spotify could capture.

Becoming an aggregator

What makes the case particularly strong for Spotify to generate revenue from podcasts is the ability of the podcast publisher to easily insert relevant ads into their podcasts. It seems Spotify has found a strong source of revenue and has used acquisitions to strengthen the proposition and become an aggregator for podcasts. To illustrate how serious Spotify is in becoming an aggregator in Podcasts, let's take a look at the recent acquisitions helping to drive this:

Podsights & Chartable (podcast analytics) Feb 2022

Whooshkaa (podcast hosting) Dec 2021

Findaway (audiobook platform) Nov 2021

Podz (podcast discovery platform, Acq for $45M) Jun 2021

Betty labs (live audio social app) Mar 2021

Megaphone (podcast tools for advertisers & publishers, Acq for $235M) Nov 2020

The Ringer (website and podcasting network, Acq for $196M) Feb 2020

Gimlet (podcast studio, Acq for $194M) in Feb 2019

We think Spotify is serious about making the best experience for creators. Spotify will make it as easy as possible for new artists and podcast creators to come onto the platform and it will become the go-to app for audio. Just as Youtube became the website for user-generated video, we think Spotify will become the place for user-generated audio. It’s worth noting that Google acquired Youtube for $1.65 billion but Youtube itself now makes $0.75 billion in revenue every week, which may show the potential of what Spotify’s revenues could become in the future.

A competitive advantage

While Spotify is the leading streaming service worldwide and it becomes the leading podcast platform, there is a technological and aggregator competitive advantage here. The advantage that Spotify has around podcasts is much stronger than the one it can put up around music, and podcasters have fewer alternatives. It is likely Spotify ends up being the winner here. Furthermore, the technology developed for improving ads generally, mostly for podcasts can be applied back to music streaming, strengthening both businesses. Ad-supported streaming advertising will likely get significantly better over time as more data is collected on Spotify’s customers.

What’s great

Profit

Revenue has grown on average around 24% per year.

Retained earnings have been growing on average 6.5% per year in the last 4 years which is great.

Cash and equivalents are decent at $2.7 billion and growing on average at 32% per year in the last few years.

Company

Stock buybacks present in the last 3 out of 5 years.

Presence of treasury stock on the balance sheet in the last 4 years.

Depreciation is low at 4% which is expected for a tech company.

Goodwill is increasing consistently.

Debt

Spotify has no short term debt and has relatively small long term debt (12.4% of 2021 revenue).

What’s okay

SGA spend is 61% of gross profit. It’s acceptable and has a weak trend downwards but this spending will likely stay as Spotify fends off the likes of Apple Music, Amazon and Youtube.

Gross margin is at 27% low, but it has tripled in the last 7 years. This is likely to improve given all the efficiencies Spotify could make with new investments.

The total return on assets is trending upwards. Spotify has $7 billion in assets, which is good as it makes it harder for a new competitor to come in.

Total Liabilities & Debt to Shareholders Equity Ratio on average is 1.45.

What isn't great:

R&D spend is high at 35% of gross profit (combined with SGA is 96% of gross profit ). While this is high it has gradually gotten lower over the years.

Interest expense looks high at 54% of operating income. However, it would be lower as Spotify produces positive net income (this year is the first year they have positive Operating Income).

Net earnings are currently -0.35% of revenue, but this has improved significantly from 4 years ago when it was at -30%. This is again likely to improve shortly.

Per-share earnings are negative and have not been consistent due to CAPEX spending, and acquisitions.

Property, plant, and equipment costs are high.

Revenue & PE ratio

Spotify has grown its revenue on average by 24% YoY. We can see EBITDA has turned positive in 2021 for the first time in the company's history. Its EV/EBITDA multiple is high, as Spotify’s EBITDA has only turned positive within the last year. However, based on today's stock price, it would have an EV/EBITDA multiple of 52.2x. We would expect this to decrease significantly as Spotify continues to grow its EBITDA. It’s also worth noting the company has very little debt overall, with a Net Debt / EBITDA multiple of 1.0x.

Cashflow

Spotify has a lot of cash on hand ($4.1B in 2021) and it is generating more cash each year. We can see the FCFE/shr is increasing. This is good as it gives Spotify the flexibility to continue spending on acquisitions and research and development. The FCFE/yield averages around 2.4% which isn’t amazing but it is good to see a stable yield despite all their acquisitions.

Forecast

Spotify's EBITDA has just turned positive and is expected to continue growing in the future. This suggests that their business is becoming more profitable. Based off Daniel Ek's statements regarding ad-supported revenue and factoring in an increase in ad-supported revenue but a decline in premium growth, we estimate an initial growth rate of around 26%. We use along term market multiple of 40x, which is lower than today’s market multiple. This gives us a target stock price of $310 in 2030.

For our FCFE forecast, we use the an average FCFE/share of 3.53 of the last 5 years. Let’s assume a it grows at a rate of 26%-10% a year. This gives us a target stock price of $572 by 2030.

We can purchase the stock at $112 today. When we average out our FCFE and EV multiple forecasts, we get a target price of $441.

Adding back the FCFE/Shr we model the future stock price at $455 in 2030. This equates to an IRR of 22% which is market beating. We’re not using aggressive numbers and we could see this outperforming an IRR of 22%, particularly if Spotify becomes the one place for podcasts but is also able to have some success around its other developments such as Spotify Live and more efficient ad targeting.

Summary

Overall, Spotify is in a good financial situation. The company makes a lot of money, and it spends heavily on research and development, as well as acquisitions. This has allowed Spotify to maintain its market share and grow its business. It is important to note that we can see the economics rapidly changing in favour, where this company will generate positive EBITDA and net income. Spotify is an example of a growth stock which becomes more reasonable in pricing.

Giles Capital confidence score: 9/10

This is a very high confidence score and we would look to buy and hold over the long term as Spotify continues to dominate podcasting in addition to music streaming.

Interested to do your own analysis?

Check out our GCS tool that helps you pull in data so you can do your own analysis in Google Sheets. This is what we use to analyse companies financials statements.

Disclosure:

We currently hold a small position in Spotify.

Disclaimer:

This is not investment advice. Our content to be used for informational purposes only. It is important you do your own analysis before making any investment based on your own personal circumstances.

About:

Sign up to our free newsletter for more analysis & recommendations:

Stay invested and follow Giles Capital on Twitter at @GilesCapital.

I like this, folks ...