The Japanese passenger railway network is the busiest in the world carrying almost 30% of global rail passengers, more than the whole of the Europe combined. We like the Japanese railway companies for their high barriers to entry, strong free cash flow and predictable earnings. Today we’ll take a look at West Japan Railway Company, the third-largest passenger railway operator in Japan by market cap.

West Japan Railway Company (TYO: 9021)

West Japan Railway Company (also known as JR West for short) operates passenger transport services in Western Honshu. It is one of the six passenger rail companies created in 1987 after the split and privatisation of Japan's nationwide railway operator. Its 5,013 kilometres of rail track covers about 34% of Japan's population and 20% of its land area. Its stable railway operations is a cash cow of this company which makes up 64% earnings with other non-regulated businesses including retail facility management, tourism, and real estate development.

It has about 6000 employees and operates in three business segments. The transportation segment provides ferry and bus transportation services in addition to its railway services. The distribution segment is engaged in the operation of department stores, catering business, the wholesale of goods, as well as the logistics business. The real estate segment is engaged in the sale and leasing of real estate properties it owns, as well as the operation of shopping centres. The company is also engaged in the hotel business, construction business and other businesses.

JR West is at the time of writing, down 47% from its pre-covid highs. It has suffered the biggest decline in stock price out of all the other JR companies. We believe this may be due to the fact that JR West covers the cities of Osaka and Kyoto, two big tourist destinations, as well as covers longer distance business and leisure travel routes, all of which have rapidly declined in usage during the pandemic.

New shares issue

Being quite an advanced railway network, JR West has high operating costs and spends a lot on capex (over 9% of its revenue). During the pandemic its debt has grown higher. To counter this, in September JR West announced it would issue an additional 48 million shares on top of the 191 million shares outstanding. This resulted in a 20% dilution and the stock has since dropped 14% since the announcement. Although this is unfortunate news for shareholders we believe keeps the company at historically normal Net debt / EBITDA levels.

Recovery

Coronavirus casts shadow over Japan’s bullet train operators. Operating revenues of JR West were down 40.4% from the previous fiscal year, to ¥898.1 billion (¥1,508.2 billion in 2020). This would count as the biggest losses since privatisation in 1987. The stock has remained low throughout various state of emergencies in Osaka.

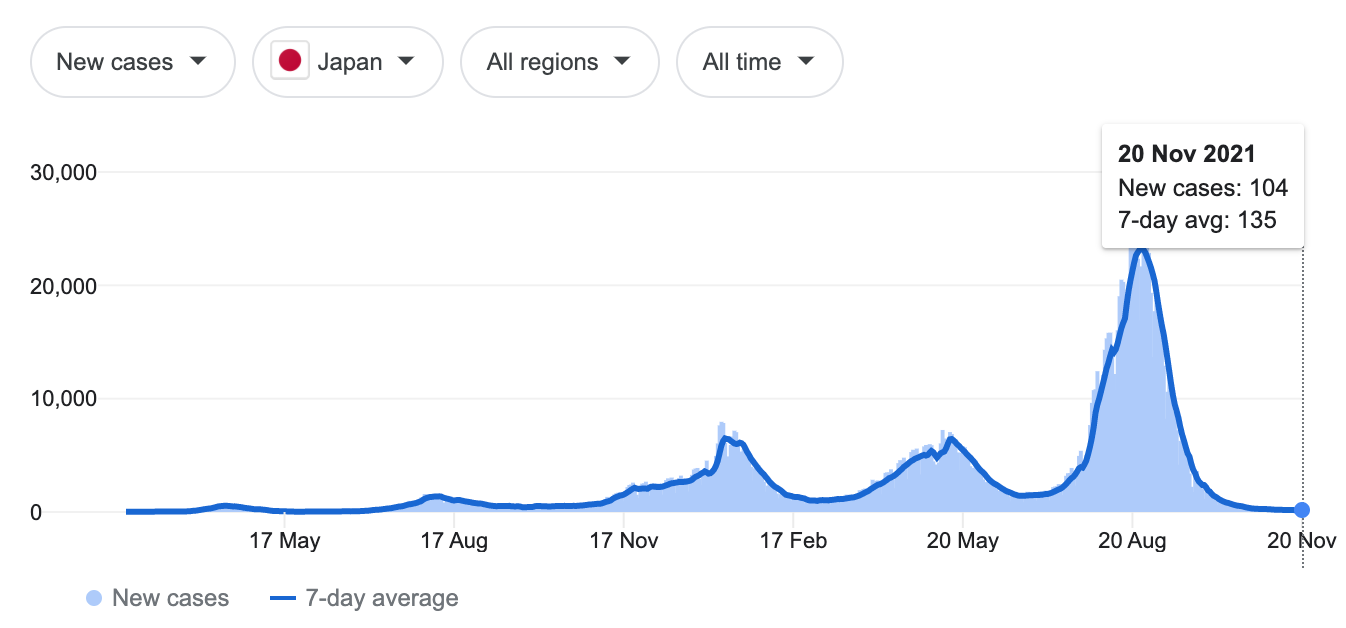

JR West owns much of the passenger rail network in Kansai region where it used to have large amount of inbound tourism. Our thesis is that Japan will eventually open for more tourists, both domestic and international, now that Japan has reached high levels of vaccination. We can now see that cases are down to their lowest in several months.

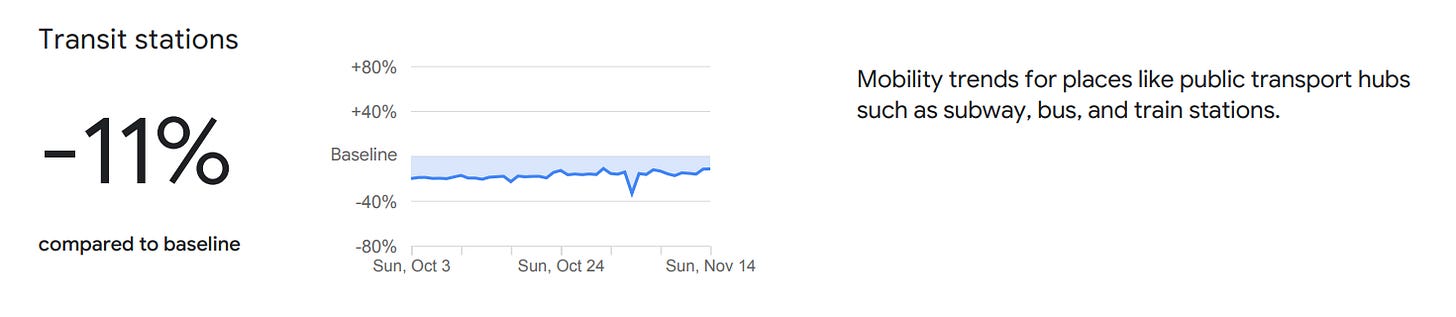

Furthermore, we can already see from the Google Mobility Report that transit stations in Western Honshu are at only 11% down in number of visits, compared with just before the pandemic. We suspect that the number of passengers may have already risen for JR West but it is yet to make any meaningful impact to its revenue or stock in the meantime.

It was reported recently on November 12, that following a recent sharp decline in coronavirus infections in Japan, the government is aiming to stimulate domestic travel demand by restarting the "Go To Travel" subsidy program around February. The program was suspended in December last year due to the spread of the virus. We think this signals a recovery at the beginning of 2022. However, we are cautious that an increase in travel could lead to a temporary rise in cases again. How much the government and the population are willing to tolerate this as a new normal is another question.

Why invest in railways?

When Warren Buffett acquired Burlington Northern Santa Fe Corp (BNSF) in 2009 it was one of the biggest ever acquisitions at the time. He believed it was a great opportunity to buy a railroad business as he was convinced it would be around for hundreds of years and would be a business that is driven by the country’s economy and will prosper with it too.

Such investments can be secure and long lasting. Railways can be overlooked but can also be great businesses. In addition to being long lasting, they have some advantages over alternative transport businesses. Trains have the advantage of fuel efficiency - about three times more efficiently than long-haul trucks. Gas prices, of course are on the rise and that gives the railways a big advantage.

Railway businesses naturally have a moat. It would be hard for any other company to build a competing railway besides or anywhere near existing tracks or networks. Railways can also get more efficient and innovate over time with new technology or services (take JR East offering office cars as an example). Lastly, although these businesses are private companies, in the case of JR Railways Group, it is almost treated like public infrastructure and would likely be protected by the government should they need extra financing. This is very similar to our bets on Cathay Pacific and Rolls-Royce, which are both heavily supported by their respective country’s governments.

The service JR West provides is still essential to many residents, business travellers and tourists, therefore the business should have a good return over time. We don’t see it going away. JR West’s only competition might be the airlines, but we think that airlines may offer passengers higher fares after the pandemic due to fuel costs and the possibility of added environmental taxes. It may be a bad few years for JR West, but it is the same stable business with the same sort of moats. With that being said, let’s look into the financials:

What’s great

Profit

Revenue over time is consistently growing at around 2% a year

Earnings per share have gradually gone up every 2 years in the last 10 years

Retained earnings growth at around a average 7% per year excluding last year

Company

Inventory growing, roughly corresponding to rise in revenue

EV/EBITDA looks cheap at 7.6 (based on pre-pandemic earnings), so the stock is well priced

Presence of treasury stock

Debt

Short term debt is good, Long term debt is fine (ratio)

Interest expensive is low (10-13% of operating income)

What’s okay

Consistent gross profit margin for a transport company at around 25% and perhaps improving overtime

Net earnings as % of revenue at around 6-7% is okay, with a small but noticeable improvement over time

Operating expense as % of gross profit are high at 51% but not bad and rather consistent

Return on shareholder equity is not amazing but not terrible at 9.51%

What isn't great:

Net income as % of revenue is low, but it looks like that had been improving over time from 2.8% to 7.36% in 2011 to 2018

Capital expenditure is high at 9.89% of revenue and larger than net income

The company has issued more shares which equates to a 20% dilution

Debt to shareholders equity ratio before pandemic was okay at around 2%, not great and has since got a bit higher

Amount of cash and equivalents is fairly low at just 1x earnings

Depreciation is high but understandable for transport

Property, plant and equipment is high but understandable for transport

Revenue & PE ratio

When looking at the financials below, we can see that revenue has fairly consistently grown in most years. If we exclude 2020, we can in fact see it has grown at roughly 2% per year. This obviously isn’t great but it the company produces a decent amount of cash. Taking the current stock price, but pre-pandemic earnings its EV/EBITDA ratio would be at a low 7.6. Furthermore with the current stock price, but pre-pandemic earnings the PE ratio would be 10, but the average in the last 5 years has been 15. This suggests potential for a significant upside.

Cashflow

Let’s take a look at the free cash flow. We can see quite a stable free cash flow being produced. Excluding 2021, that’s an average of 4.4% FCFE/yield every year, which is decent for a transportation company.

Forecast

Forecasting the price of a stock that has been beaten down in the pandemic is hard, as it’s really hard to predict how fast or slow things will recover. The forecasts we use are not really great at taking this into account giving a 2030 target that would be less than pre-pandemic, which I don’t think is realistic. To counter this, I have added a historic PE ratio forecast, looking at the earnings per share growth.

For our EV multiple forecast, we can assume EBITDA will grow. Taking analyst’s forecasts, we assume an improvement as we get out of the pandemic - this is not unrealistic given Japan’s vaccination rates. We then predict a slow increase of EBITDA 1% annually. This gives us a target stock price of 5896 yen:

For our FCFE forecast, although there is an average FCFE/share of 4.4, let’s assume a conservative FCFE/share of 4.0 in line with prior years. We’ll also use a similar growth rate growth rate as above at 1%. This gives us a target stock price of 11869 yen.

We’ve also added our P/E ratio forecast, looking at EPS increasing 10% per year. Averaging out these three forecasts gives us a share price of 11638 yen by 2030.

Adding the FCFE/Shr back we model the future share price at 12112 yen in 2030. This equates to an IRR of 16% which is market beating. We’re not using aggressive numbers and we could see this easily outperforming an IRR of 16%, particularly in the short term.

Summary

Overall the companies fundamentals aren’t the best, but they are not bad either. Although JR West is an investment heavy company, the pandemic has probably made it leaner, reducing costs and perhaps leaving it with the possibility of coming out the pandemic as a healthier business.

This is really a recovery play and you’d be buying into a company that is unlikely to go away, has access to cheap debt and can be supported by the government if necessary. We think that a recovery in Japan is looking better than most countries in Asia and that tourism to Japan would rebound very quickly. Of course there’s some uncertainty and it could take time, so we give this idea a confidence score of 7/10.

Giles Capital confidence score: 7/10

Hold for the short term until a full recovery has taken place. It could possibility be a longer term hold given tourism is likely to remain high after a recovery.

Interested to do your own analysis?

Check out our GCS tool that helps you pull in data so you can do your own analysis in Google Sheets. This is what we use to analyse companies financials statements.

Disclosure:

We have held a position in West Japan Railways since early this year.

Disclaimer:

This is not investment advice. Our content to be used for informational purposes only. It is important you do your own analysis before making any investment based on your own personal circumstances.

About:

Sign up to our free newsletter for more analysis & recommendations:

Stay invested and follow Giles Capital on Twitter at @GilesCapital.