Sushiro (Food & Life Companies Ltd TYO: 3563)

Sushiro (Food & Life Companies Ltd TYO: 3563) has been aggressively expanding overseas. The parent company has recently rebranded to 'Food & Life' companies. Their mission: to bring delicious food and dishes to everyday meals and provide enriching experiences to our customers. There's a lot to like about this stock from it’s ambition to it's numbers. This article shares what we're seeing here at Giles Capital.

The situation

Expansion has been rapid. At the beginning of 2018 Sushiro had no presence in Hong Kong. In just over the span of two years, Sushiro now has six outlets, with that set to double to twelve this year. Despite opening more stores demand is still strong. Many customers face long queues and this has even led to Sushiro halting online ticketing due to tickets being resold online. This speaks volumes about it's popularity.

Of course, Hong Kong is a specific market where Japanese goods are popular. We could look at the retailer Don Don Donki as another example of Japanese expansion in Hong Kong, which similarly has opened five outlets in the city. However, we're also betting that Sushiro has a further reach and a strong competitive advantage.

Competitive advantage and global reach

We believe Sushiro is very well run and has excellent training capabilities and technology for their global rollout. We also like the detail of their financial reports. It's clear Sushiro has many experiments to drive up revenue.

Although known to be a 100 yen Sushi store, an example of their experiments include introducing a higher price point (480 yen) with launching 'Super size shrimp' sushi as an example. The involvement of more technology in stores is also impressive. Practical and effective, Sushiro Hong Kong is leveraging Youtube live stream to show the current ticket numbers so customers can check what numbers are being called from wherever they are.

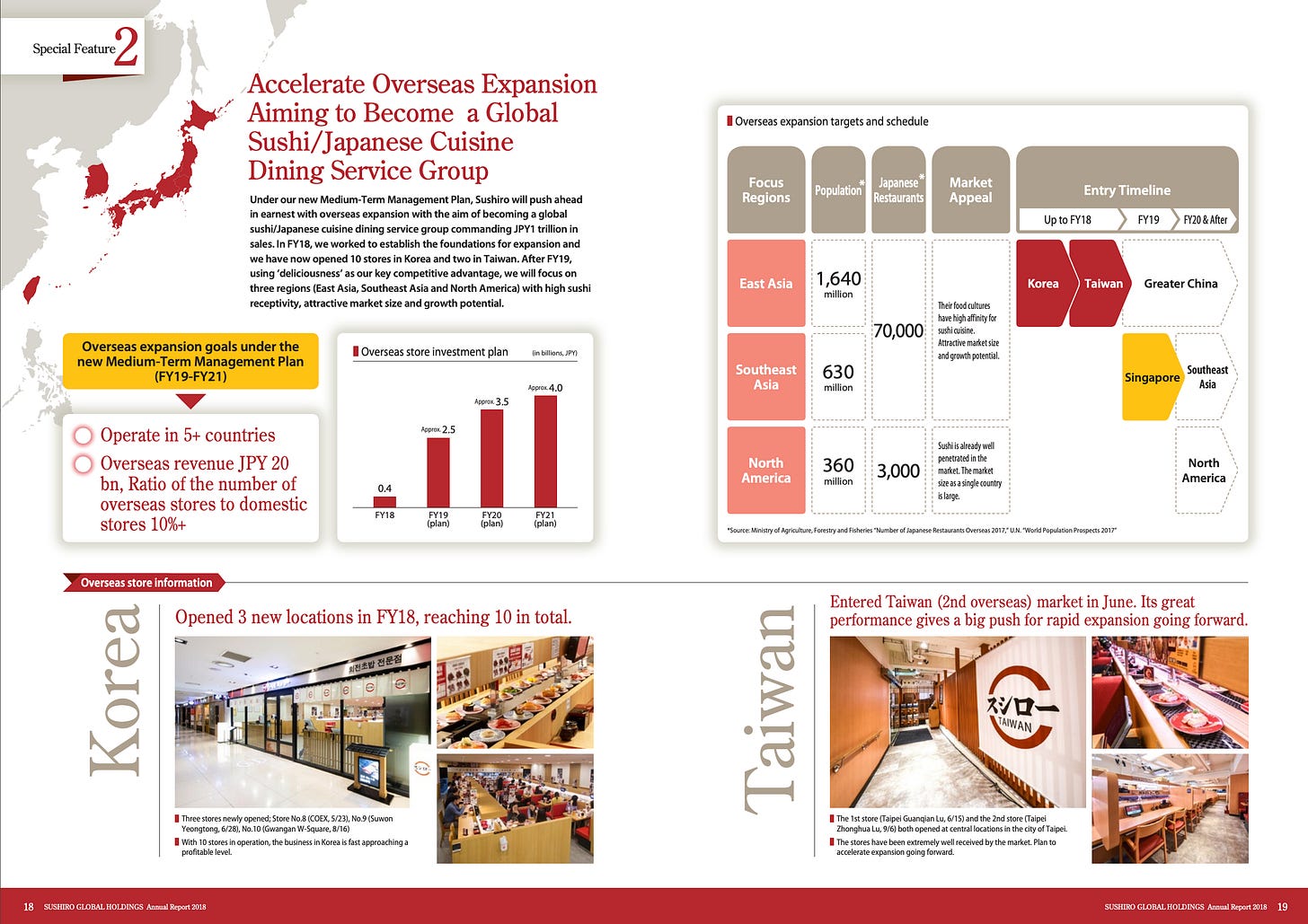

Sushiro also has a pattern of expansive growth, which we think is going extremely well judging by the net income growth. We can see Sushiro continuing to expand internationally throughout the next several years, with China and North America being huge markets which do not yet have the balance of quality and price of Sushiro's restaurants.

Genki Sushi, a rival Japanese sushi restaurant chain that grew internationally two decades ago, has proved such expansion works. In the last few years, Sushiro and Genki Sushi tried to strategically merge, but now that has failed we see Sushiro competing and taking market share from Genki Sushi, as it becomes the preferred choice for consumers.

Furthermore Sushiro is not only it's Sushi restaurants. Food & Life Companies Ltd own Sharetea Japan. The company also undertook a further investment in Wasabi UK, bringing their ownership to approximately 50 percent. Their venture in the UK will allow Sushiro to test the British market, as well as combine knowledge from both companies. Food & Life Companies Ltd is also trying out a new Izakaya restaurant chain in Japan. With the experiences Sushiro gain from their international expansion and it's constant improvements, we could see added growth from these other parts of the business in the near future.

Modelling Sushiro's growth and share price performance

At Giles Capital we have worked on a model, based on number of stores, profitability of stores and previous stock prices to try and forecast Sushiro's growth and even future share price performance. There are a lot of assumptions made (a full list at the end of the article) but we use what we know to make the forecast.

Forecasting Sushiro's growth

We can see that Sushiro has been steadily growing in Japan, with the number of stores on average increasing 4.87% per year. However, due to an ageing population in Japan, which is eating less and less sushi, coupled with the Covid situation in Japan, it has motivated Sushiro to start expanding aggressively abroad.

In the last 3 years, the lowest year on year increase for overseas stores is 53.85%, based on the given numbers by Sushiro on their target 2021 openings. This is the number we are also using for 2022 openings, which we think could be on the conservative side. With this data we get a good picture on a steady overall store expansion, which notably didn't stop during 2020, and looks like it could pick up speed as the situation improves.

With these numbers we can estimate the income per store over the years. For the last 4 years, income per store on average has been 14.6 million yen. It seems to have grown every year, except 2020 where it's obvious the pandemic has had an impact. Given that 2021 should see improvement, I've conservatively forecasted that the average income per store will be 12 million yen in 2021 and 14 million yen in 2020.

Excluding our forecast and looking back at the last 5 years, we see an average yearly revenue growth of 8.62% and an average yearly income growth at 30.69%. This also suggests that Sushiro benefits from economies of scale and are also improving their profitability overtime.

Forecasting Sushiro's share price

This is the most speculative part of this model, but we have explored it given what we know and how the share price has behaved in the past. By no means is past performance indicative of future performance, but with a stock that has been gaining momentum and with an improving global situation, it might just be possible.

We can use a simple share price target formula to form price targets for each year. As we've predicted future earnings, we can use a forward PE Ratio to get the following price targets: 1,238 for 2020, 2,976 for 2021 and 6,088 for 2022. As we can see below, these price targets and ones of the previous years are well below how the shares have actually behaved. In an attempt to account for this, I've made an adjusted price target which includes a multiple, which aims to get the share price right (on average) over the last few years.

When adjusted, this gives a price target of 4,369 for 2021 and 8,939 for 2021. These numbers change depending on the projected income. However, if we put in Sushiro's own projections for 2021 income we get extremely close to the current share price. What we think is interesting here is, regardless of which estimation (conservative model or adjusted model) it gives a higher share price target for 2022 than the current price.

Not fully satisfied, we looked at another method which is to look at the ratio of net income vs market cap. Interestingly Sushi and Genki have very similar ratios of 1.1 and 1.2, which gives an indication of how these companies are valued by the market.

If the ratio of net income to market cap remains at around 1.1% we can forecast what the share price might be. We found at a share price 7,450 we get a marketcap of 9.85 billion. 1.1% of this, as net income is 9,851 million. This is a very similar amount to our forecast of Sushiro’s net income for 2022. This is an interesting result, as a target share price of 7,450 for 2022 is right between our conservative and adjusted models.

Of course, this is a bit of an arbitrary way to make a forecast, but if nothing drastic changes, we can see that between our model and this, the share price could increase anywhere from 16% to 71% by end of 2022. We can easily see this happening as Sushiro successfully expands through mainland China and into Europe and the US. We are long Sushiro (Food & Life Companies Ltd TYO: 3563) and look forward to receiving further updates from management.

Assumptions:

Creating a simple model is better overall. There are of course some big assumptions I've made:

To improve accuracy, average percentages overtime does not include future estimates.

Domestic revenue of 2021 actually seems similar to that of last year. Therefore my model takes a conservative number of improvement of income per store.

Estimation for revenue per store does not take into account Sushiro's new development stores or Sharetea outlets (only 1 or 2). However, I believe this is negligible for estimation, as the majority of the revenue is from Sushiro stores and should not effect the estimation that much.

The model also assumes all stores domestic vs international have similar revenue but this may not be the case. However, in my model it actually underestimates the overseas revenue (19 billion vs actual 24 billion) which might be why Sushiro's own 2021 revenue estimates might be higher than ours, with the expansion of more overseas stores.

The model assumes the number of shares remain static.

References:

Disclaimer:

This is not investment advice. Our content to be used for informational purposes only. It is important you do your own analysis before making any investment based on your own personal circumstances.