Navigating the 2024 US Presidential Election: An Investment Framework

48 Actionable Ideas for the upcoming Election. Estimated reading time: 24 minutes

While Giles Capital typically focuses on covering a range of investment opportunities via our weekly newsletter and select company write-ups, the approaching US presidential election has the potential to impact any investment portfolio and warrants careful examination. Though this analysis could certainly prove incorrect, the goal is simply to provide a framework for thinking through these important market considerations and also act as a process for shortlisting investment ideas.

Electoral Patterns Point to Shifts

Nate Silver, who previously founded FiveThirtyEight and now publishes on his own Substack (Silver Bulletin), has consistently demonstrated superior accuracy in presidential election forecasting. As the only major platform to give Trump meaningful odds (28.6%) in 2016, when others showed sub-5% probability, their current forecast deserves particular attention. His model now shows Trump with a 53.4% chance of victory – their first-ever prediction in his favour.

His battleground states data reveals significant movement since 2020, with key states showing dramatic shifts:

Pennsylvania: From Biden +1.2% to Trump +0.3%

Georgia: From Biden +0.3% to Trump +1.6%

Arizona: From Biden +0.3% to Trump +2.1%

Michigan: From Biden +2.8% to Trump +0.7%

Nevada: From Biden +2.4% to Even

Wisconsin: From Biden +0.6% to Trump +0.4%

These shifts are significant considering potential historical polling bias. Silver's models have consistently underestimated Trump's performance – by 69 electoral votes in 2016 and 59 votes in 2020. Recent analysis from Silver Bulletin reveals a striking pattern where likely voter polls favour Harris by 0.5 points nationally but favour Trump by 0.5 points in battleground states, suggesting his Electoral College position may be even stronger than topline polling indicates.

Silver’s model now shows a 24% probability of Trump winning all battleground states – the single most likely outcome in Silver's simulations. This seems to be driven by multiple factors beyond traditional polling metrics, including strong voter concerns about immigration and border security, persistent economic anxieties despite improving data, and broader global shifts against immigration policies, as evidenced by recent policy changes even in traditionally welcoming countries like Canada.

When adjusted for historical polling bias and these emerging patterns, these shifts could suggest an even stronger position for Trump than surface-level polling indicates. This potential outcome has significant implications for market positioning, particularly in sectors sensitive to trade policy, immigration reform, and fiscal stimulus.

The Druckenmiller Signal Stanley

As Trump gains in polls, Druckenmiller's recent positioning is noteworthy. His track record speaks volumes: 30% annual returns over three decades, successfully navigating major market shifts that others missed. His recent move to allocate 15-20% of his portfolio to shorting Treasury bonds stands out as one of his highest-conviction trades in recent years.

His thesis rests on four key pillars: 1) persistent inflation driven by potential trade policies, particularly renewed China tariffs, 2) fiscal policy shifts leading to increased deficit spending, 3) supply chain reconfigurations adding to cost pressures, and 4) markets underpricing these combined inflationary forces. The potential for a significant increase in the yield on the 30-year Treasury bond reflects his view that markets haven't fully priced in risks related to persistent inflation and fiscal policy changes

Druckenmiller's historical success in identifying policy-driven market shifts adds particular weight to this position. His major wins include profiting from the Plaza Accord currency shifts in 1985, the breakdown of the British pound in 1992, and navigating the 2008 financial crisis. Each success came from identifying policy shifts before they became consensus, similar to his current positioning. The size of his Treasury short position suggests similar conviction about upcoming market shifts.

Possible Sector Rotation

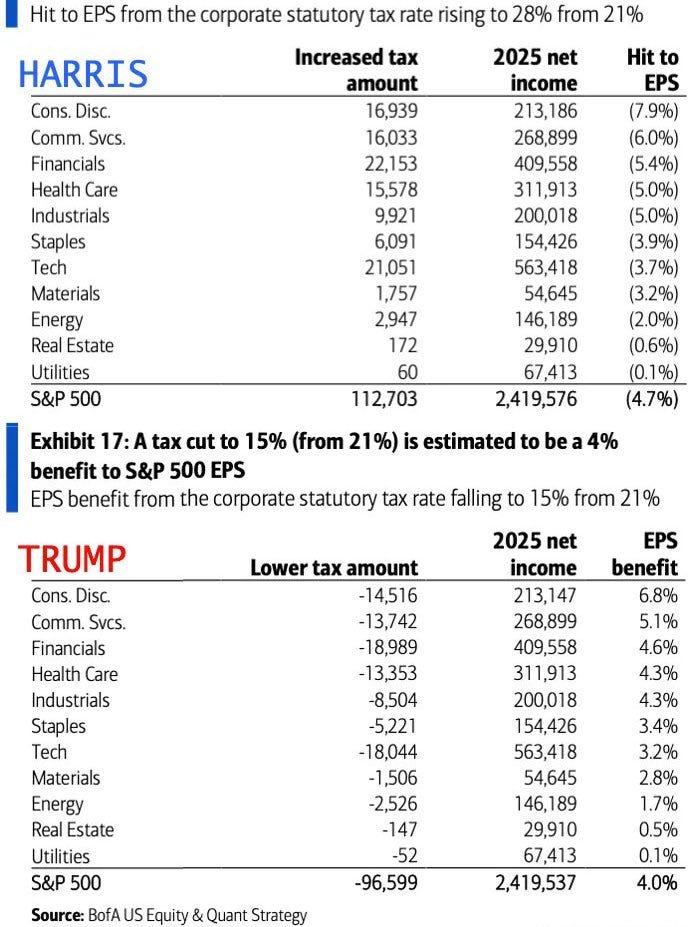

Bank of America's US Equity & Quant Strategy research reveals significant sector implications. Under a Trump victory, consumer discretionary stocks could see a +6.8% EPS boost, driven by tax policy benefits for retailers and automakers, while tariff protection helps domestic manufacturers. Increased infrastructure spending would further benefit homebuilders and construction related sectors. Communications services (+5.1%) and financials (+4.6%) would also show meaningful upside potential from anticipated deregulation.

The analysis reveals equally significant downside risks under a Harris administration. Consumer discretionary faces a -7.9% EPS impact, while communications services (-6.0%) and financials (-5.4%) show similar vulnerability. This divergence creates opportunities for both long and short positions.

The electric vehicle sector appears particularly exposed. The potential elimination of tax credits (currently worth up to $7,500 per vehicle) combined with challenging unit economics creates significant headwinds. Many companies in this space operate with negative margins even with current subsidies, suggesting significant downside risk.

Building an Investment Framework

With the looming macro risks as well as potential policy shifts under a Trump presidency spurring sector rotation, I have worked an investment framework to try to account for these influences. The framework builds on both Druckenmiller's macro view and specific Trump policy proposals.

I set out to score each relevant investment idea on the following: Policy and macro impact represents a majority (60% of the score), examining direct policy benefits, secondary market effects, inflation thesis alignment, and electoral sensitivity. Value protection contributes 15% of the scoring, focusing on asset backing, balance sheet strength, and cash flow sustainability. Risk asymmetry accounts for another 15%, weighing upside catalysts against downside protection and scenario resilience. Market capitalisation makes up the final 10%, with an assumption that smaller market cap stocks have the greater potential to rise.

Consider Alpha Metallurgical (AMR) and Rivian (RIVN) as contrasting examples of the scoring process:

Policy & Macro Impact:

Direct Policy Benefits (AMR 18/20 vs RIVN 5/20):

AMR: Key supplier to domestic steel industry and an infrastructure spending beneficiary

RIVN: Federal subsidy elimination threatens core business model

Secondary Effects (AMR 14/15 vs RIVN 3/15):

AMR: Energy independence focus, reshoring benefits, supply chain nationalism

RIVN: Rising interest rates impact vehicle financing, increased competition

Economic sensitivity forms another crucial component. Companies with strong pricing power and domestic supply chains typically outperform in inflationary, protective trade environments. The framework particularly values businesses with operational leverage to policy changes, while maintaining protection against alternative outcomes.

This manifests in scoring through:

Value Protection (AMR 14/15 vs RIVN 4/15):

AMR: Net cash position, assets below replacement cost, minimal capex needs

RIVN: Ongoing cash burn, high capital intensity, premium to tangible value

Given the uncertainty around the election, the alternative outcome needs to be considered. Investments showing asymmetric return profiles, where upside potential significantly outweighs downside risk, score higher. The framework seeks opportunities, particularly in infrastructure and defence, showing potential resilience regardless of outcome. For example, AMR as a key supplier to domestic steel production provides value in any scenario prioritising U.S. manufacturing, with its strong balance sheet and cash flow generation, scores highly. For example:

Risk Asymmetry (AMR 13/15 vs RIVN 5/15):

AMR: Hard asset backing, high free cash flow generation, strategic value to steel sector

RIVN: Unit economics challenged even with subsidies, rising competitive threats

This scoring approach identifies opportunities where policy tailwinds align with fundamental value, creating situations where multiple independent factors could drive appreciation while downside risks remain limited by business quality and asset value. The resulting scores guide our prioritisation across sectors and market segments but serve as a starting point for deeper analysis rather than definitive answers.

Investment Opportunities

Using this framework, I have identified 48 actionable opportunities across materials, financials, energy, industrials, ETFs, and tactical shorts. In addition to the scoring system above, the analysis assigns ‘Trump case’ and ‘Harris case’ scenarios representing a 12-month return potential under each administration, which helps to identify the most compelling risk-adjusted opportunities in a potential policy shift environment. Let’s start with the highest-scoring ideas.

Overall Top Ideas

These positions score highest by combining policy benefits, the Druckenmiller thesis alignment and asymmetric risk/reward profiles. Each demonstrates multiple independent catalysts with defined downside protection.

Cleveland-Cliffs (CLF US - $8.0B) Vertically integrated steel producer trading at 6.5x earnings. Benefits from tariffs and infrastructure spending. Controls 100% of iron ore supply creating natural hedge. Auto exposure (30% revenues) positions for reshoring benefits.

Ferrexpo (FXPO LN - £500M) Trading at 1.1x EV/EBITDA with net cash position of $106M. Ukraine peace negotiation catalyst under Trump presidency. Iron ore assets valued below replacement cost. A perfect Druckenmiller inflation hedge.

ProShares UltraShort 20Y Treasury (TBT US - $4.2B) Direct play on Druckenmiller's treasury short thesis. Current 4.9% yield suggests upside to 5.5% target. Leveraged structure magnifies returns while maintaining defined risk parameters.

US Steel (X US - $12.0B) Trading at 4x earnings with direct tariff exposure. New electric arc furnace investments reduce environmental risk. Strong automotive and infrastructure exposure. Benefits from reshoring initiatives.

Occidental (OXY US - $55B) Premier Permian Basin operator at 6x free cash flow with Berkshire backing. Trump energy deregulation and drilling permits provide direct benefits. Strategic petroleum reserve refill policy supports margins. Production costs among lowest in industry.

Alpha Metallurgical (AMR US - $2.5B) Pure play met coal producer at 3.5x earnings. Benefits from increased infrastructure spending and steel tariffs. Net cash position with aggressive buyback program. Key supplier to domestic steel mills.

Central Europe Fund (CEE US - $120M) Trading at 5% discount to NAV with Russian optionality. Zero value assigned to frozen assets creates free upside option. Eastern European equities at significant discount to developed markets.

Russell 2000 ETF (IWM US - $52B) Small cap domestic focus which aligns with Trump policy benefits. Trading at historical valuation discount to large caps. Maximum exposure to infrastructure and reshoring themes. Efficient implementation vehicle.

Rolls-Royce (RYCEY US - $25B) Potential defence spending surge under Trump's NATO policy shift and promised military buildup. Trump's focus on nuclear deterrence directly benefits RYCEY's submarine program.

Western Alliance (WAL US - $6.0B) Trading at 1.1x tangible book value. Strong deposit franchise with tech focus. Maximum interest rate sensitivity. Potential beneficiary of regulatory relief under Trump administration.

ETF / Index vehicles

The ETF / Index vehicles category provides efficient implementation of the key macro themes discussed with enhanced liquidity. The vehicles selected maximise exposure to Trump policy benefits and Druckenmiller's inflation/rates thesis.

ProShares UltraShort 20Y Treasury (TBT US - $4.2B) Primary implementation vehicle for Druckenmiller's rates thesis. Leveraged structure provides enhanced return potential with defined risk parameters. Current 4.9% yield suggests significant upside to 5.5% target. Most liquid option.

Russell 2000 ETF (IWM US - $52B) Maximum exposure to domestic policy beneficiaries trading at historical discount to large caps. Small cap value tilt aligns with inflation protection theme. Options market provides efficient overlay strategies. 82% domestic revenues.

SPDR S&P Regional Banking ETF (KRE US - $2.2B) Pure play on regional bank policy benefits and rate sensitivity. Equal weight methodology maximises exposure to potential Trump regulatory relief. Trading at 1.2x tangible book value versus 2.0x historical average.

SPDR S&P Metals & Mining ETF (XME US - $1.8B) Broad exposure to tariff and infrastructure beneficiaries trading at 6x average earnings. Equal weight reduces single stock risk while maintaining maximum policy sensitivity. Hard asset backing provides inflation protection.

VanEck Steel ETF (SLX US - $0.75B) Direct exposure to steel tariffs and infrastructure spending at 5x average earnings. Global holdings provide trade policy optionality. Underlying assets valued below replacement cost offers downside protection.

iShares US Regional Banks ETF (IAT US - $1.5B) Market cap weighted exposure to high-quality regional banks at significant discount to historical valuations. Strong correlation to Druckenmiller's rate thesis. Conservative portfolio construction reduces volatility.

SPDR S&P Oil & Gas ETF (XOP US - $3.5B) Equal weight energy producer exposure maximizing benefits from deregulation and domestic production growth. Trading at 5x average cash flow with significant capex flexibility. Strong inflation hedge characteristics.

iShares US Infrastructure ETF (IFRA US - $1.0B) Targeted exposure to infrastructure spending beneficiaries across materials, construction and engineering. Small/mid cap tilt increases policy sensitivity. Portfolio trading at significant discount to replacement value.

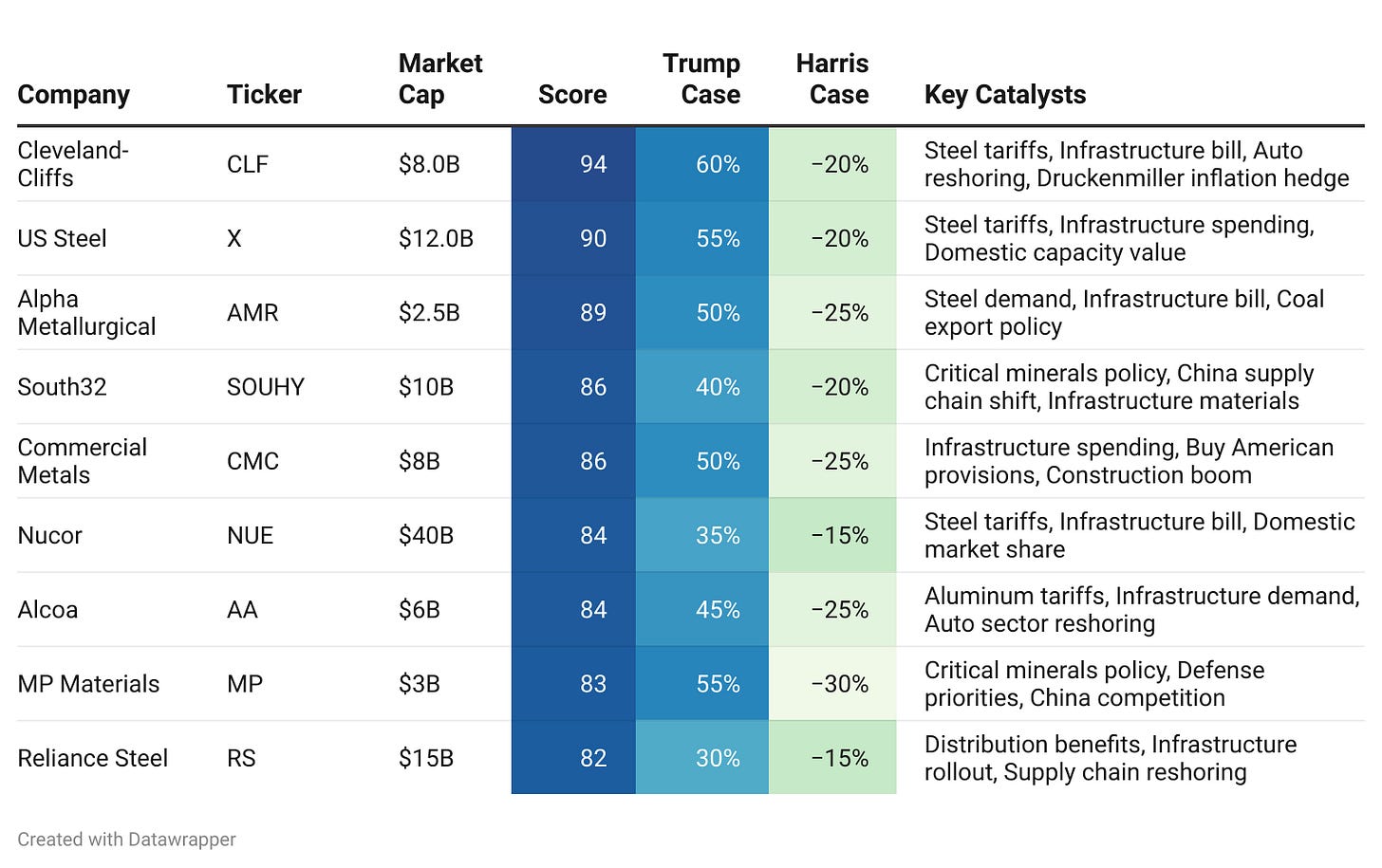

Materials and mining

This sector combines multiple independent catalysts from tariffs, infrastructure spending and inflation protection. Hard asset backing provides downside support in all scenarios. The companies selected maximise exposure to policy shifts while offering value support through replacement cost metrics.

Cleveland-Cliffs (CLF US - $8.0B) Expanding margins from operational efficiencies. Recent debt reduction strengthens balance sheet. Vertical integration provides unique advantages in protectionist environment. Strategic value in consolidating industry.

US Steel (X US - $12.0B) Highest operational leverage to steel prices. Electric arc furnace investments reduce environmental risk. Strategic value of domestic capacity creates M&A optionality. Key auto and energy sector supplier relationships.

Alpha Metallurgical (AMR US - $2.5B) Pure play metallurgical coal producer at 3.5x earnings with net cash position. Direct beneficiary of steel tariffs and infrastructure spending. Aggressive buyback program retiring 15% of shares annually. Key supplier to domestic mills.

South32 (SOUHY US - $10B) At 6x earnings, major beneficiary of Trump's critical minerals policy and China supply chain restrictions. 40% production in US-allied nations aligns with reshoring push.

Commercial Metals (CMC US - $8B) At 8x earnings with Trump's $1T infrastructure plan directly benefiting as 40% revenue from public projects. Mexican tariffs would advantage US production vs imports.

Ivanhoe Mines (IVPAF US - $12B) Below replacement cost, positioned for Trump's critical minerals strategy targeting China dependency. Key copper/nickel assets align with defence supply chain focus.

Nucor (NUE US - $40B) Most efficient domestic steel producer at 6.5x earnings with consistent through-cycle margins. Vertical integration and low-cost position provide competitive advantages. $4B investment program expanding higher-margin product capabilities.

Alcoa (AA US - $6B) Pure play aluminium producer at 0.8x book value. Direct beneficiary of potential Chinese tariffs. Low-cost assets and vertical integration provide margin protection. Major automotive sector exposure aligns with reshoring initiatives.

MP Materials (MP US - $3B) Only scaled rare earths producer in U.S. trading at 8x EBITDA. Critical defence supply chain role enhances strategic value. Processing facility expansion provides significant growth runway. China trade tensions increase domestic importance.

Reliance Steel (RS US - $15B) Largest metals service center at 7x earnings with consistent margins through cycle. Distribution advantages and scale provide competitive moat. Diverse customer base reduces sector risk. Strong balance sheet supports continued consolidation.

Financial services

Financial services offer multiple catalysts from deregulation, rising rates, and potential accounting relief. There is a strong correlation with Druckenmiller's macro thesis while trading at significant discounts to historical valuations. Balance sheet quality and regulatory scrutiny since 2008 provide downside protection.

SVB Financial (SIVB US - $3.0B) Trading at 0.6x tangible book post-crisis despite maintaining core tech banking franchise. Maximum interest rate sensitivity among regionals provides perfect Druckenmiller thesis alignment. Regulatory relief catalyst under Trump.

Western Alliance (WAL US - $6B) Regional leader trading at 1.1x tangible book with superior deposit franchise. Rate sensitivity and tech focus provide growth catalyst. Strong credit metrics and capital position reduce risk. Trump regulatory agenda adds optionality.

Evercore (EVR US - $5B) Premier independent advisory firm at 10x earnings despite secular M&A growth. Trump policies likely to accelerate corporate activity through deregulation. 40% operating margins through cycles with significant backlog building.

Zions Bancorp (ZION US - $5B) Western U.S. focused bank at 1.2x tangible book with strong commercial lending franchise. Significant rate sensitivity and growth market exposure. Clean credit history and strong capital provide downside protection in stress scenario.

KeyCorp (KEY US - $12B) Trading at significant discount to tangible book despite middle market lending dominance. Rate sensitivity and fee income diversity provide earnings catalysts. Strong deposit franchise and credit metrics support dividend sustainability.

Raymond James (RJF US - $20B) Wealth management pure play at 2x tangible book with significant rate sensitivity. Trump regulatory agenda benefits wealth segment. Capital markets optionality provides upside while recurring revenues protect downside.

Lazard (LAZ US - $3B) Global advisory platform at 8x earnings with restructuring wave optionality. Recession scenario creates countercyclical earnings support. 6% dividend yield paid from recurring asset management earnings provides downside protection.

Regions Financial (RF US - $15B) Southeast focused bank at 1.1x tangible book with strong small business franchise. Pure domestic exposure aligns with Trump policy benefits. Conservative credit culture and strong capital support substantial capital return.

First Citizens (FCNCA US - $15B) Trading at modest premium to tangible book despite SVB acquisition benefits emerging. Strong core deposit franchise with proven acquisition integration capabilities. Conservative credit culture provides protection through cycles.

Citizens Financial (CFG US - $14B) Northeast/Midwest franchise at tangible book despite consumer banking momentum. Rate sensitivity and market position provide earnings catalysts. Capital return capacity over 100% of earnings demonstrates balance sheet strength.

Jefferies (JEF US - $8B) Middle market investment bank below book value despite trading business hedge. M&A and capital markets recovery provide upside optionality. Strong balance sheet and buyback capacity support value proposition through cycles.

Special situations

This category captures unique catalysts or asymmetric setups beyond broad macro exposure. There is a focus on company-specific drivers with hard asset backing or strategic value providing downside support. Multiple independent catalysts reduce dependence on single scenario.

Ferrexpo (FXPO LN - £500M) Trading at 1.1x EV/EBITDA with net cash position and high-grade iron ore assets. Ukraine peace negotiation catalyst under Trump administration could unlock 100%+ upside. Critical infrastructure position for European steel industry.

Central Europe Fund (CEE US - $120M) Trading at 5% discount to NAV with significant Russian asset optionality. The idea from Capital Valor (@CapitalValor) highlights zero value assigned to frozen assets creates free upside option. Eastern European recovery potential combined with policy shift catalyst under Trump.

Spirit Airlines (SAVE US - $1.4B) Trading at distressed levels ($2.79) with Frontier merger optionality. Fleet value provides asset coverage while industry consolidation trend continues. Trump's pro-merger stance could support Frontier or other deals.

Peloton (PTON US - $2B) Trading below $500/subscriber vs. $2000+ acquisition cost. Trump's anti-China tariffs would squeeze competitors while David Einhorn sees significant asset value in subscriber base/content library.

Tutor Perini (TPC US - $0.8B) Deep discount to book value despite significant infrastructure spending exposure. $4B backlog provides earnings visibility. Potential settlement of legacy claims could unlock significant value. New management driving operational improvements.

Great Lakes Dredge (GLDD US - $0.5B) At 0.8x book value despite being key beneficiary of Trump's $1T infrastructure plan focused on port expansion. 80% of revenue from federal/state contracts..

Industrial and defence

This sector combines infrastructure spending benefits with defence budget expansion potential. There is a focus on companies with strong market positions and significant backlog visibility. Balance sheet strength and cash flow generation provide downside protection.

Rolls-Royce (RYCEY US - $25B) Potential defence spending surge under Trump's NATO policy shift and promised military buildup. Trump's focus on nuclear deterrence directly benefits RYCEY's submarine program.

MasTec (MTZ US - $7B) Infrastructure services leader trading at 8x earnings despite record backlog. Direct exposure to energy transition and traditional infrastructure spending. Clean energy expertise provides growth hedge regardless of administration.

EMCOR Group (EME US - $10B) At 12x earnings, a pure play on Trump's promised defence facility and infrastructure buildout. 70% revenue from government/military contracting aligns with spending priorities.

Summit Materials (SUM US - $4B) Trading below replacement with Trump's Buy American provisions directly benefiting domestic materials. Infrastructure plan requires US-sourced materials..

Eagle Materials (EXP US - $7B) Pure play construction materials producer with best-in-class margins. Vertical integration and low-cost position provide competitive advantages. Infrastructure spending and housing recovery create multiple demand drivers.

Granite Construction (GVA US - $2B) Infrastructure pure play at 0.8x book value with $4.5B backlog. New management driving operational improvements and margin expansion. Infrastructure bill provides multi-year revenue visibility and potential upside surprises.

Sterling Infrastructure (STRL US - $2B) Specialised infrastructure contractor at 10x earnings despite 20% margins. E-commerce and data centre expertise provides growth diversification. Strong balance sheet and improving execution support continued organic growth.

Semiconductors and tech

The tech sector benefits from reshoring initiatives and national security priorities. Focus on companies with domestic expansion plans and strong market positions. Significant free cash flow generation provides downside protection despite cyclical exposure.

Lam Research (LRCX US - $90B) Critical semiconductor equipment supplier at 15x earnings with 30% margins. Domestic capacity expansion and China restrictions create sustained growth runway. $5B annual free cash flow supports aggressive capital return.

Applied Materials (AMAT US - $120B) Industry leader trading at 16x earnings despite record backlog levels. Key enabler of semiconductor reshoring with 70% market share in key processes. Strong balance sheet supports continued R&D investment through cycles.

KLA Corporation (KLAC US - $65B) Process control leader at 16x earnings with 60% market share. Essential for leading-edge manufacturing with no credible competitors. $3B annual free cash flow and net cash balance sheet support continued innovation leadership.

ASE Technology (ASX US - $15B) Only 10x earnings despite being largest assembly player that benefits from Trump's Taiwan support and reshoring push. 40% capacity outside China provides immediate alternative.

Intel (INTC US - $150B) Trading at 1x book value while Trump's China chip ban and $20B Arizona fab align perfectly with campaign's domestic semiconductor focus. CHIPS Act benefits accelerate under Trump.

AMD (AMD US - $180B) At 25x earnings with Trump's China chip restrictions set to accelerate server share gains from 5% to 20%+. Campaign pledged support for US semiconductor leaders.

Micron (MU US - $75B) Memory leader at 1.2x book value despite cyclical trough. $100B investment in domestic capacity adds strategic value. Industry consolidation and China restrictions improve long-term pricing power.

Energy and infrastructure

The energy and infrastructure sector combines deregulation benefits with inflation protection. There is a focus on companies with strong asset positions and capital discipline. Free cash flow generation supports shareholder returns while commodity exposure provides macro hedge.

Devon Energy (DVN US - $30B) Premier shale producer at 4x free cash flow with variable dividend strategy. Permian Basin position supports decade of high-return drilling. Strong balance sheet and disciplined capital allocation protect through cycles.

EOG Resources (EOG US - $70B) Best-in-class operator at 5x free cash flow with premium drilling strategy. Technical leadership drives superior returns and inventory depth. Zero net debt provides ultimate financial flexibility and shareholder return capacity.

Williams Companies (WMB US - $45B) Trump's promised LNG export push and pipeline deregulation directly benefits natural gas infrastructure. Strategic assets for energy independence policy..

Baker Hughes (BKR US - $35B) Key beneficiary of Trump's drilling deregulation and energy independence push. Service provider to expanding US oil/gas production under looser rules.

Valero Energy (VLO US - $45B) Most efficient refiner at 5x earnings with coastal export capacity advantages. Renewable diesel leadership provides transition hedge. Strong balance sheet and cash flows support continued high shareholder returns.

Marathon Petroleum (MPC US - $50B) Integrated refining leader at 6x earnings post-retail separation. Midcontinent system provides crude advantage and product export optionality. Aggressive buyback capacity from retail sale proceeds.

Diamondback Energy (FANG US - $30B) Pure play Permian producer at 5x free cash flow with tier-one inventory. Premium assets support decade of sub-$50 breakeven drilling. Acquisition capacity could drive further consolidation benefits.

Consumer Discretionary

Consumer Discretionary provides leverage to policy-driven consumer strength. There is a focus on companies with pricing power and strong market positions. Value-oriented consumer exposure reduces recession risk while maintaining upside participation.

Ford (F US - $50B) - 84 - Trading at 6x earnings despite EV transition momentum and F-150 dominance. Direct beneficiary of potential China tariffs and reshoring initiatives. UAW contract clarity removes uncertainty while inflation recovery supports pricing power.

GEN Restaurant Group (GENK US - $2B) Rapidly growing Korean BBQ concept at 15x earnings with 40% unit growth. Small business tax cuts and consumer boosts magnify 40% unit/strong margin growth. Labor rollbacks may ease expansion costs.

Carnival (CCL US - $15B) Trading at significant discount to replacement cost of fleet. Post-COVID capacity discipline and pricing power drive margin recovery. New ship efficiency and slowing industry supply support sustained pricing environment.

Thor Industries (THO US - $6B) RV leader at 6x earnings with counter-cyclical inventory dynamics. European expansion diversifies growth while maintaining value focus. Strong balance sheet and market share gains provide cycle protection.

Academy Sports (ASO US - $4B) Sunbelt-focused retailer at 7x earnings with 20% operating margins. Value positioning and private label penetration protect margins. Strategic real estate portfolio provides additional value support.

Texas Roadhouse (TXRH US - $7B) Value-oriented casual dining leader with consistent traffic gains. Rural/suburban focus aligns with population shifts. Strong unit economics support continued expansion while pricing power protects margins.

Meritage Homes (MTH US - $5B) Entry-level focused builder at 8x earnings with strong land position. First-time buyer focus provides demographic tailwind. Asset-light model and conservative balance sheet reduce cycle risk.

Media and Communications

This sector benefits from potential deregulation under Trump administration. Focus on companies with strong market positions and valuable content/spectrum assets. Local news and sports rights provide unique value in fragmented landscape.

Liberty Media (LSXMA US - $10B) - 84 - Formula 1 and sports franchise owner trading at significant discount to asset value. Potential deregulation in media ownership enables strategic options. Sports betting expansion and F1 growth provide multiple catalysts.

Fox Corp (FOXA US - $15B) News leader trading at 8x earnings with strong election cycle exposure. Sports rights and affiliate fees provide stable cash flows. Local station ownership valuable in consolidating market. News dominance strategic in election cycle.

DISH Network (DISH US - $4B) Spectrum assets valued below market comparables. 5G network buildout nearing completion reduces capital needs. Strategic value to multiple partners given spectrum scarcity. Satellite business free cash flow funds transition.

Sinclair (SBGI US - $1B) Local broadcasting leader at 6x earnings post-RSN separation. Direct beneficiary of political advertising cycle. Potential deregulation catalyst for industry consolidation. Diamond Sports resolution removes overhang.

Sirius XM (SIRI US - $15B) Audio entertainment leader at 12x earnings with stable subscription model. Connected car penetration drives growth while content costs largely fixed. Liberty ownership provides strategic options. Strong free cash flow supports buybacks.

Large Cap Tech

Given the Magnificent Seven's unprecedented 28% weighting in the S&P 500, understanding potential policy impacts on large cap tech is crucial for portfolio positioning. The following analysis examines specific risks and opportunities across major tech platforms while acknowledging their outsized impact on broader market performance.

Microsoft (MSFT US - $3T) -Cloud leadership and AI positioning support premium multiple. Enterprise focus reduces regulatory risk versus consumer tech. Strategic importance in national security tech race provides policy hedge.

Amazon (AMZN US - $1.5T) E-commerce and cloud infrastructure leader with expanding margins. Logistics network build-out complete drives improving returns. Advertising growth and AWS dominance support valuation despite regulatory scrutiny.

Meta (META US - $1T) Core platforms at 20x earnings with engagement stability proven. AI efficiency gains driving margin expansion while Reels monetization improves. Regulatory concerns more than reflected in multiple.

Alphabet (GOOGL US - $1.7T) Search dominance at reasonable multiple despite regulatory risk. Cloud momentum and YouTube growth provide diversification. AI leadership and strategic importance offer partial policy protection.

Apple (AAPL US - $2.8T) iPhone ecosystem at premium multiple faces China exposure risk. Services growth and Indian manufacturing hedge geopolitical risk. Capital return capacity provides support while brand strength enables pricing power.

NVIDIA (NVDA US - $1.1T) AI leadership demands significant premium despite geopolitical risks. Strategic importance in tech race provides partial hedge. Gaming recovery and datacenter dominance support growth despite valuation concerns.

Strategic Shorts

This strategic shorts category focuses on companies facing combined policy and fundamental headwinds. Selected names combine poor unit economics with demanding valuations in challenging policy environment. Each target offers asymmetric risk/reward with multiple catalysts for valuation compression.

Rivian (RIVN US - $20B) Cash burn exceeds $5B annually against $9.1B cash balance. Production costs remain above selling price even with tax credits. Market cap implies $400k per vehicle versus Tesla at $120k. Credit elimination would immediately impact demand.

ChargePoint (CHPT US - $2B) Network utilidation rates below breakeven at 5-7% despite government support. Current valuation assumes significant infrastructure subsidies continue. Revenues growing 37% but losses expanding faster at 45%. Utility competition threatens margins.

Lucid (LCID US - $10B) Cash burn approaching $2B per quarter with deliveries missing targets by 60%. Average selling price of $175k limits addressable market. Factory utilidation below 25% despite capacity investments. Luxury EV segment facing increasing competition.

First Solar (FSLR US - $15B) Trading at 15x earnings at cyclical peak driven by subsidies. Significant capacity expansion increases operating leverage risk. Chinese competition and potential tariff changes threaten pricing power. Policy changes could strand investments.

QuantumScape (QS US - $3B) Pre-revenue battery technology requiring billions in additional capital. No clear path to commercialisation before 2025. Multiple competing technologies with major OEM support. Rising rates increase financing risk materially.

Nikola (NKLA US - $1B) Challenged hydrogen strategy with limited infrastructure support. Multiple management credibility issues and restated financials. No clear competitive advantage in increasingly crowded sector. High cash burn threatens viability without subsidies.

Final thoughts

Our highest conviction ideas include some of the names I have followed closely. Rolls-Royce, our first company write-up on this Substack, has demonstrated the value of patient positioning in specific sectors. Similarly, our deep dive on Ferrexpo earlier this year aligns with the asymmetric opportunity in Eastern European assets that we see reflected in similar ideas such as the Central Europe Fund.

Despite market uncertainty heading into the 2024 election, this analysis identifies several compelling opportunities with asymmetric risk-reward profiles. While maintaining broad portfolio diversification, I would like to highlight the following ideas in particular:

Cleveland-Cliffs (CLF) represents our highest conviction opportunity, where vertical integration provides natural hedges against input cost inflation while control of domestic iron ore supply creates significant strategic value. Trading at just 6.5x earnings with substantial asset backing, it exemplifies the policy-driven opportunities we seek.

Ferrexpo (FXPO) presents exceptional asymmetry, trading at just 1.1x EV/EBITDA with a net cash balance sheet. A resolution of Ukraine tensions under a Trump administration could drive a rerating of 100% or more, while current pricing provides significant downside protection through hard asset value.

ProShares UltraShort 20Y Treasury (TBT) offers efficient exposure to Druckenmiller's rates thesis with defined risk parameters. Current yields suggest significant upside potential as markets price in sustained inflation and expanding deficits under potential Trump fiscal policies.

For broader market exposure, I’d recommend the Russell 2000 ETF (IWM) which provides exposure to domestic small caps trading at historical discounts to large caps. The structure efficiently captures potential benefits from reshoring initiatives and infrastructure spending while maintaining strong liquidity.

On the short side, Rivian (RIVN) presents a compelling opportunity with its $5B annual cash burn against dwindling cash reserves and potential elimination of EV tax credits under a Trump administration. Production costs remain above selling prices even with current subsidies, suggesting material downside risk as policy support potentially wanes.

These positions combine analysis of fundamental value with specific catalysts in an environment which could lead to large revaluations. Each offer multiple ways to win while providing some downside protection through asset value or business quality. While the inherent uncertainty of electoral outcomes add risk, a carefully chosen set of investments across different sectors could be worth considering when building a diverse portfolio.

Disclosure: Currently hold positions in several financial and industrial sector companies mentioned in our framework.

Disclaimer: This is not investment advice. Our content is to be used for informational purposes only. It is important you do your own analysis before making any investment based on your own personal circumstances.